A robust client engagement letter is crucial in the accounting industry. But the truth is, engagement letters are a major pain point for most accountants and bookkeepers.

Getting compliance right in your accounting firm can be a difficult task, but it doesn’t need to be. All you need is the right systems in place to do the hard work for you.

Although not glaringly obvious, investing in your client engagement letter process reaps many benefits. By neglecting the ‘boring’ legal stuff, you expose your firm to risk and the consequences can be severe.

So why is an engagement letter so important for accountants and bookkeepers?

What will you learn?

- Challenges accounting business owners face in the industry

- Why should you invest in compliance?

- Not having a robust engagement letter in place can be detrimental

- Difficulties with building a robust library of engagement letters

- A solution that has built a SMART suite of engagement letters for accountants

Challenges accountants face in the industry

I’m sure you have your specific reasons for why you took the step and started your own accountancy firm. And now you’re here, you’ve realised there’s so many different factors to consider…

- How do you find clients in in the first place?

- How do you recruit good staff? What’s your recruitment process like?

- Once you’ve recruited good staff, how do you train them? How do you pay them more?

- How do you handle difficult clients?

- How do you systemise your business so it can scale and run without you?

- How do you stay compliant?

Being a business owner is challenging. You may be an expert in your craft, but you have all of these other business areas that you have to learn fast.

Yet you’re not trained in these areas, especially to the level that you need to survive commercially in this world.

Out of the factors mentioned above, one really sticks out to me. It sticks out by the fact that it doesn’t stick out to other business owners:

Staying compliant and getting the legal formalities correct within your business.

If you fail to get other things right such as marketing, selling, recruiting, it becomes glaringly obvious to you because you don’t have the clients or coming in nor are you making enough money.

"If you don't have your compliance right, there's a good chance that you don't know it"

Perfect all the other factors and you reap so many obvious benefits for your business. But, if you get your compliance on point, you don’t clearly benefit from it. It’s just perceived as ‘protecting you from things going wrong’.

So you many think ‘what’s the point?’

Why should accountants invest in client engagement letters?

Meeting the highest levels of compliance in your business takes time, effort and money, so why should you prioritise getting it right?

Because your accountancy firm is exposed to risk for many different reasons:

1. You deal with complex clients

Your services are complicated, but your clients are complex.

Businesses by their nature are very complex – you can have a husband and wife led businesses which is great whilst they’re married but not necessarily if they get divorced.

You can have partnerships that go sour.

You can have complexities of businesses operating in different territories.

These are all situations where things can go wrong, and you as the accountant could face repercussions.

2. You handle sensitive data

You and your team manage sensitive data for your clients, and this could be sensitive data from multiple directors or partners within a business. If your firm works with confidential information, it’s your responsibility to minimise the risk of that data being misplaced or lost.

3. You give critical advice to your clients

You must make sure the advice you give is very specific and clearly articulate what to use it for.

Recently, a handful of large firms have received multi-million-pound fines because they gave advice in one plane, but the client used that advice for something else.

If the specifics aren’t clearly stated in in the terms, your business doesn’t have a leg to stand on.

Unfortunately, it doesn’t matter how small that piece of work is, it must be identified and covered in your client engagement letters.

4. You pay bills on behalf of your clients

Get this wrong and it can cause huge problems because it affects so many people.

Until recently, I was a director at an accounting firm and paying bills on behalf of clients caused huge issues.

You only need to get it wrong a couple of times and you wipe out the entire profit for that service across all your clients.

5. You help your clients to meet deadlines and obligations

Whose fault is it if your client fails to get their tax returns done on time and come to you towards the end of January even though you’ve been asking for that information for months? It’s a grey area unless the responsibilities are clearly stated in an engagement letter.

I understand it’s sometimes difficult to rationalise and justify spending a good amount of money on making sure you get your compliance right in your business because you’ve never had to use it in the past.

But the truth is, you only have to use an engagement letter once to more than cover the time and money it took to create it.

"There are only two types of firms: those who have had a claim made against them or those who are going to have a claim made against them"

We live in a far more litigious society and when things go wrong with businesses, they’re very quick to look for people to blame. You may think you have a good relationship with your clients, but I assure you when their back is up against the wall and something goes wrong, they will be looking to claim from you.

A solid, robust engagement letter will help to protect you in this scenario, so you don’t have to pay out nor waste your time fighting the claim.

Are you sitting on a time bomb?

I’m going to tell you a story about a husband and wife led company.

They engaged an accountancy firm and everything was working well until they got an acrimonious divorce.

During this turbulent time in the business, the wife realised the engagement letter didn’t have multiple signatures on it and only the husband signed it.

As the husband signed for everything, the accounting firm acted on his instructions and the wife questioned why their accountant would do that when they were both directors of the business.

She went to the professional body, but they rejected her claim.

So, she went to a lawyer and the law firm got involved to try and sue the accountancy firm but again, it wasn’t successful.

You may be thinking ‘so what’s the issue?’. The problem was that it took over 250 hours of the accounting firm owner’s time to solve the dispute.

Imagine if someone said to you ‘I need you for 250 hours over the next three months, you have no choice, you’re not going to be paid for it and it’s going to be highly stressful.’

Sadly, that’s enough to close a small accounting business down.

In this instance, if the firm had a robust library of engagement letters that met the highest levels of compliance, they would have stopped the claim dead in its tracks and detonated the ticking time bomb.

Important issues with client engagement letters

Why is it such a difficult task to create a suite of compliant engagement letters? Because there’s so many different factors to consider…

1. Fulfil your regulatory obligations

You must uphold your professional bodies regulations for each service you provide. In recent years, they have been quick to issue fines when people don’t meet their regulatory obligations.

Get your FREE Practice Assurance Checklist

2. Perfectly reflect your firm’s circumstances

As circumstances change within your business, you must be able to update your engagement letters quickly and easily to reflect these changes to ensure you’re remaining compliant with each engagement.

3. Scoped for the entities that you serve

For example, if you provide an engagement letter to a charity, there are lots of different variations of that charity, how it’s set up, where it’s registered and what territories it covers in order for you to pick the correct engagement letter out.

4. Meet the specifics of each engagement letter e.g. key dates & multiple signatures

It’s not enough to have an engagement letter that states you’re going to engage your client from a certain date if they’re going to continue to manage payroll themselves for another month and their previous accountant is going to complete last years’ annual accounts.

You need to be very specific in your document to say you’re engaging your client from a certain date but you’ll be responsible for different services on different start dates. To fully minimise risk, you shouldn’t take responsibility for a service that you no longer provide. Therefore, you need to build key dates for each service into your engagement letters.

You must include multiple signatures so everyone involved in that engagement with the client can sign the engagement letter. Whether they’re a key person of responsibility or solely signing the privacy policy, it needs to be mapped out in the engagement letter. As this is a difficult admin-based task to carry out, accountants typically avoid it. But the moment you do that, the time bomb starts ticking away.

5. Be CLEAR so all parties understand

You can use engagement letters to strengthen your client relationships. You need to change the perspective of compliance from being internally focused and protective of yourself, to being mutually focused and protective of the relationship. A clear, transparent engagement letter sets a great example for your clients.

How do accountancy firms stay compliant?

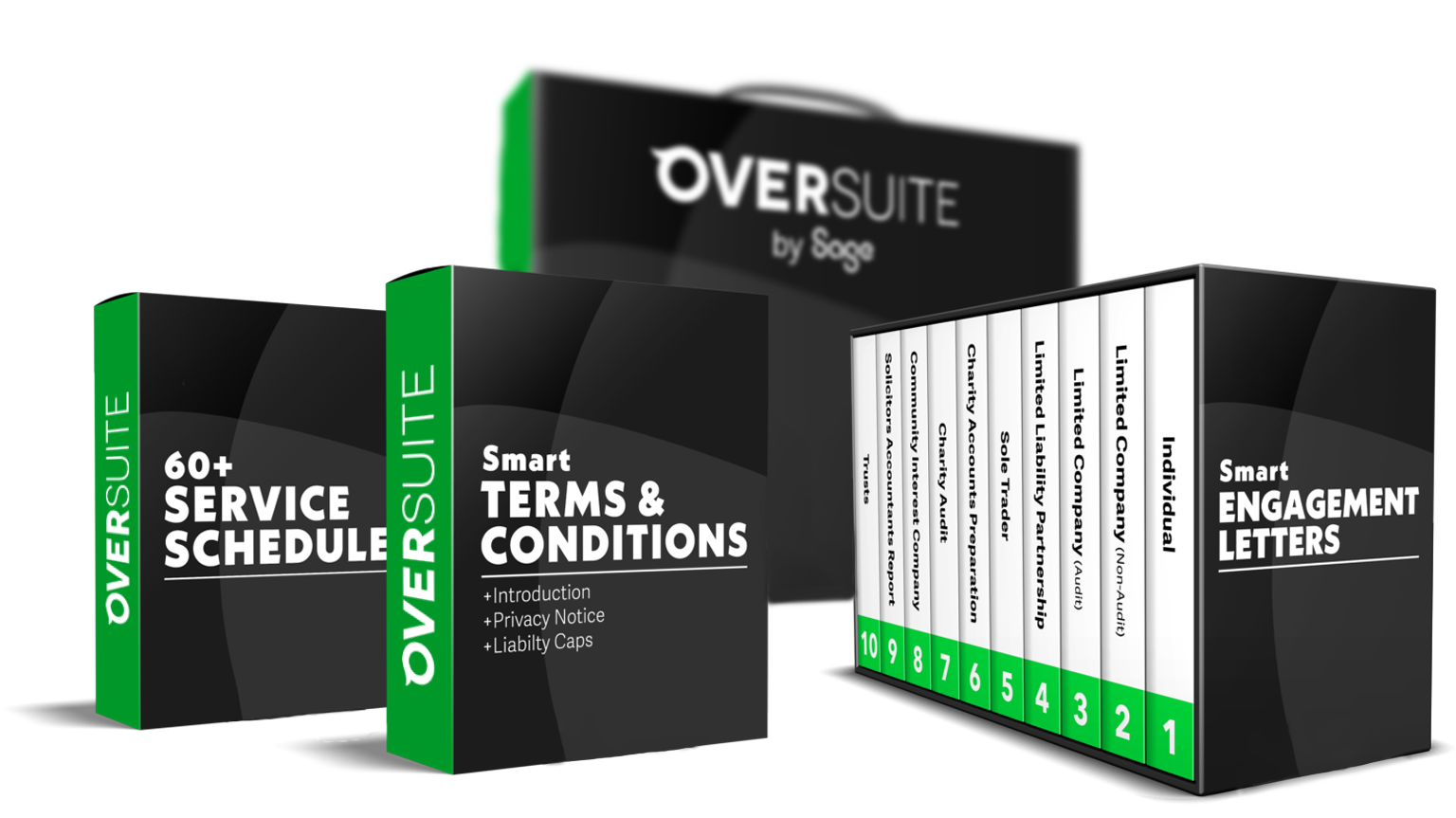

If you want to be fully confident that your firm is being compliant with every client and your engagement letters will protect you against all situations… OverSuite is the right option for you.

OverSuite is the only engagement letter solution for accountants with expert advice built into each section of the system.

The engagement letters are clear and concise. You no longer need to decipher through engagement letter templates praying that the lengthy document you’ve created will protect you.

With OverSuite, you create a library of engagement letters made specific to your firm’s circumstances in less than 10 minutes.

Our compliance experts review the contents of your OverSuite engagement letters every quarter, so they are consistently up to date and compliant with any regulatory changes. You don’t need to search for the information yourself as the changes will automatically be reflected in your documents and communicated to you.

As OverSuite is extremely simple to navigate, all members of your team feel empowered to produce an engagement letter. It no longer needs to solely be the business owner producing these documents, so you remove the bottleneck in your accounting business.

Lastly, your engagement letter process is no longer laborious. It’s no longer the tedious piece of admin at the end of an exciting conversation. You can draft and send an engagement letter in minutes to save time and engage with clients quicker. Having a seamless engagement process in place improves the entire onboarding experience and demonstrates client care.

Ready to get started and give OverSuite a go?

Get Your Suite of Smart Engagement Letters with OverSuite

Meet the highest levels of risk and compliance standards with our suite of Smart Engagement Letters for accountants that evolve with regulatory changes & are auto-updated for you.

Header image from Pexels, photographer Bongkarn Thanyakij